Investment returns are a funny thing. As the warnings on financial products typically state, “past performance does not guarantee future performance,” yet past returns are by far the main factor clients look at when selecting an investment product. For no other financial product does this hold more true than mutual funds. Mutual funds are priced with daily performance open for the whole world to see and ask, “What has my mutual fund done for me lately?” In fact, when I was managing a popular mutual fund, I was being called by wealth management advisors regarding the estimated return of the fund on an intra-day basis, i.e. 12:00, noon, i.e. if the market was 0.5%, I was asked how much was the fund up, now. This focus on returns is misguided.

Mutual fund companies are complicated organizations, as are the people working inside them. Mutual fund companies are primarily marketing organizations focused on gathering assets by promoting investment returns, which are then underwritten by the investment management team. As a result, there is pressure on mutual fund managers to perform with hyper focus on the return game, while at the same time needing to devote considerable time to marketing activities. This dichotomous tension results, in the best case, of valuable time wasted by investment managers on marketing activities; and in the worst case, in the launch of “fad” mutual funds from driving using the rear-view mirror.

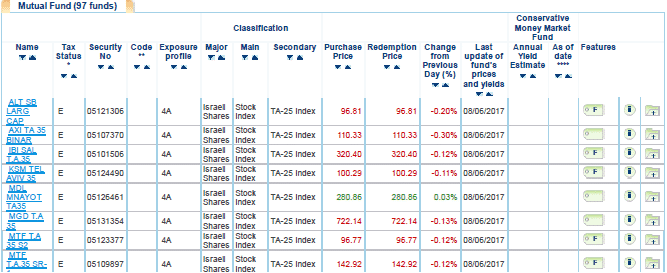

The second aspect is the choice of mutual fund companies, the correct product within the myriad of choice, and lastly to be managed by the right manager.

The wrong investment house might be in the process of being silently acquired by another company, leaving staff more concerned in updating their CVs than servicing clients. The wrong investment house might have a tendency to cremate their funds that blew up, never to be seen or heard from again. Or perhaps to silently reclassify their poorly performing investment funds into easier peer performance categories in order to whitewash them. Or more commonly, they might be radio stations that always seem to be playing the newest song in town.

The wrong product is more nuanced. Investors want the highest level on investment management and this is simply the firm with the best investment ideas and the managers who know how to execute on these ideas on risk/reward constraint. It is very difficult for an outsider to choose the right product from the large product menu that most firms offer. All too often, the investor chooses badly, and watches haplessly other funds within the same firm that provided better returns.

Mutual fund managers are severely limited by regulation and internal compliance from trading on their own account. However, the best investment advice from a mutual fund manager is the answer to this question, “Which fund from your fund family would you invest in?” The answer to this question is worth money in the bank. Why? Because the mutual fund manager – due to compliance – might invest his own personal money in mutual funds as the least regulatory problematic option and which funds does he know the best? The fund he manages, as well as those of his colleagues – this is legal inside information at its best. He knows which investment teams are struggling, which funds might have toxic assets or even hidden assets, which sector is most promising on investment merit and not marketing hype.

The last point is size. Smaller funds have an advantage over larger funds. It is far easier to navigate a small boat than an ocean liner. When managing large funds, the investment choices are initially screened for liquidity. No matter how compelling the situation is, if it would be impossible to accumulate a decent position, it is rejected. The cost of building up a position without moving the price is also a factor on the entry, but even more so on the exit side if there is a need to sell due to change in investment or unforeseen redemptions. Here is the key takeaway – I would even request this be referenced in my name –

“Within a mutual fund family, a smaller mutual fund will usually outperform the larger mutual fund when operating under roughly similar objectives.”

This is important for a number of reasons. Typically, the small fund will be serviced by the same research team as the large fund. When new investment ideas are produced, the small fund might piggyback on the larger fund’s buying power, thereby providing an almost implied “put” option to its holding. The smaller fund will typically have a lower management fee in order to entice investors and will also have an advantage in being able to accumulate positions more easily without incurring frictional trading costs. Further, often there are funds which are similar but might have different names or classes, and only a forensic analysis of holdings will yield the golden nirvana of the best investment management of the firm in the lowest cost wrapper.

Lastly, smaller funds outperform, but when they become big funds, they find it more difficult. This holds especially true in Israel, where the top performing funds have beaten the larger funds, and based on their stellar returns have now become the “big boys.” These firms are now awash with new funds, with their back offices flooded with capital flowing in as their funds take top position on 1, 3 and 5 year performance tables. The fund flow has catapulted these firms’ assets and the ability to rely on past performance is diminished, because the new fund is growing by leaps and bounds every day and the manager’s main job is to deploy these assets as quickly as possible, as his portfolio becomes diluted by the new cash. Likewise, his time is now even more stretched by marketing activities as the demand to present to banks and advisers is greater than ever. This is a far cry from the situation a few years ago and as such the product is unalterably changed. Whether the firms manage this growth is not the mutual fund investor’s problem, he is not a shareholder participating in the growth of the mutual fund firm. But qualitatively the firm and product have changed, and for top-performance ranked mutual funds, the warning “past performance does not guarantee future returns” resonates even more strongly.

The information on this site is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any securities to any person or a solicitation of any person of any offer to purchase any securities or investment products.