Articles

GE and Israel Long-Term-Care Insurance

Long term care insurance = Siudi Insurance = ביטוח סיעודי For decades, GE was regarded as a highly successful conglomerate with a wide range of profitable businesses, however since the financial crisis of 2008 its fortunes have turned and the company has had many...

Potential years of life lost

Potential Years of Life Lost (PYLL) is an intriguing indicator that I came across while browsing OECD’s (Organisation for Economic Co-operation and Development) latest health care data (my weekends are exciting!). This indicator is a summary measure of premature...

Israel Retirement Funds’ Returns Equity Allocations

At this time of year insurance companies, pension funds, provident and sabbatical funds are sending their annual statements for calendar 2017. The statements provide a summary of contributions made during the year, tax documents and data regarding fees and returns....

Lessons from US LTC Insurance

In the US, long-term care ("LTC") insurance is a major issue as the cost of quality nursing care is expensive and can last many years. Policymakers are concerned about the aging population and the long-term costs to care for the elderly. Insurance companies are...

Compulsory Pension for Self-Employed

Within the 2017 Framework Legislation, the Government legislated new changes for retirement and benefits in order to ensure that the self-employed will be better prepared for retirement and periods of unemployment. The law now requires a minimum contribution for...

2017 Israel Financial Planning Letter

As a new Jewish year begins, it is time once again to reflect on how we can help our clients navigate the ever-changing financial environment and look for meaningful takeaways for the new year ahead of us. Asset prices both in Israel and globally continue to rise...

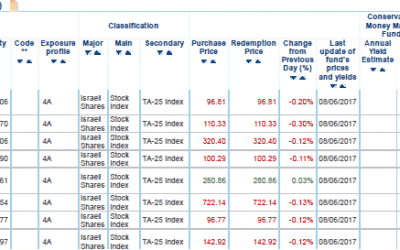

Israel Investment Fund Performance Returns

Investment returns are a funny thing. As the warnings on financial products typically state, "past performance does not guarantee future performance," yet past returns are by far the main factor clients look at when selecting an investment product. For no other...

What is Tikun 190 and Why you should be interested – public

What is Tikun 190 and Why you Should be Interested What is Tikun 190? Over the past decade the Israeli Government has been encouraging citizens to ensure they have long-term savings for retirements. A classic example would be a doctor who is working in a public...

What happens to your pension when you change jobs

Most people will change jobs a number of times over the course of their working life, with some even changing their profession as well. Aside from the challenges in navigating your career, there is a further challenge in handling your retirement accounts with each...

Retirement plans savings options

Whichever retirement plan type you are invested in – pension fund, provident fund or manager's insurance- there are options regarding the level of risk ranging from conservative to aggressive you can choose. The level of risk is typically defined as the percentage...