by Moshe Klempner | Oct 9, 2017 | Article

As a new Jewish year begins, it is time once again to reflect on how we can help our clients navigate the ever-changing financial environment and look for meaningful takeaways for the new year ahead of us. Asset prices both in Israel and globally continue to rise...

by Moshe Klempner | Jun 11, 2017 | Article

Investment returns are a funny thing. As the warnings on financial products typically state, “past performance does not guarantee future performance,” yet past returns are by far the main factor clients look at when selecting an investment product. For no...

by Moshe Klempner | May 1, 2017 | Article

Most people will change jobs a number of times over the course of their working life, with some even changing their profession as well. Aside from the challenges in navigating your career, there is a further challenge in handling your retirement accounts with each...

by Moshe Klempner | May 1, 2017 | Article

Whichever retirement plan type you are invested in – pension fund, provident fund or manager’s insurance- there are options regarding the level of risk ranging from conservative to aggressive you can choose. The level of risk is typically defined as the...

by Moshe Klempner | May 1, 2017 | Article

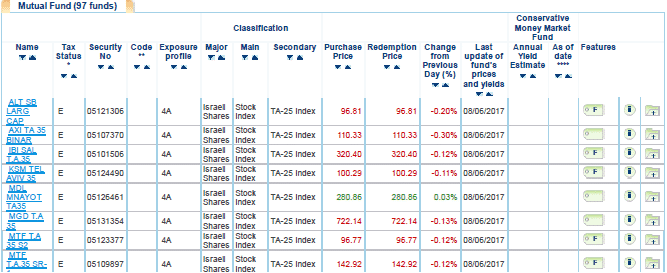

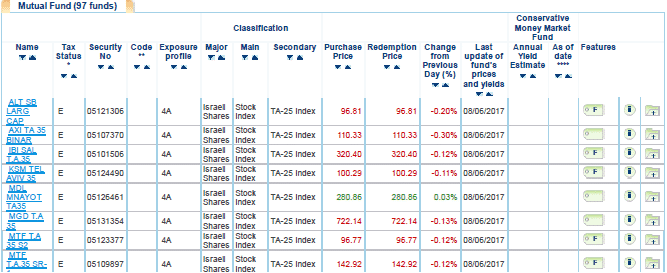

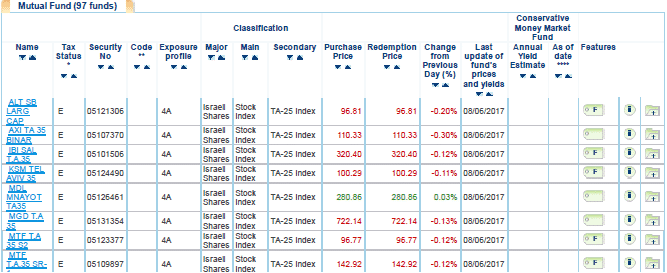

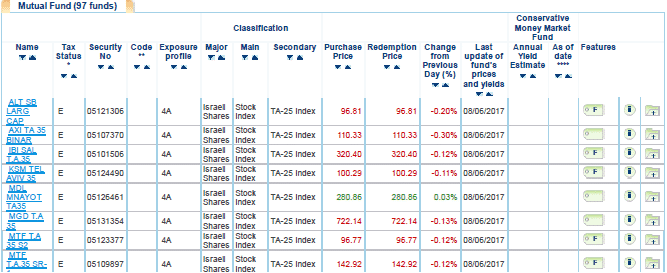

Options for Saving and Investing There are many ways to save and invest money in Israel, in the article below we will outline a few of the most popular. Bank Deposits and Bank Savings Plans (תוכניות חסכון) This is the classical way for saving money due to the very low...

by Moshe Klempner | May 1, 2017 | Article

Manager’s Insurance (Bituach Minhalim) One of the confusing retirement products in Israel is the popular Managers Insurance or Bituach Minhalim. This is retirement savings policy that typically includes life insurance and disability insurance. The amounts...