Investment Portfolio Management

- Our goal is to produce the most appropriate investment solutions for our clients. These solutions reflect our philosophy of diversification and risk management. We believe that consistent, disciplined adherence to this philosophy provides investors the best results over time.

- Specifically, we develop broadly diversified portfolios with exposure to equities – including domestic small and mid cap stocks and international equities – as well as fixed income securities and alternative investments and strategies. We believe that such diversification helps to limit portfolio downside risk – a key to long-term success.

- We further manage risk by continually analyzing every major asset class and market. Each investment team in turn participates in our Investment Policy Committee, allowing all of our clients to benefit from the extensive knowledge of one of the most experienced firms in the investment industry.

Our investment philosophy is brought to bear on each client portfolio. Portfolios are individually managed by an investment team dedicated to the investment style recommended to and chosen by the client.

We manage investment portfolios in Israel Shekels, US Dollars, Sterling, Euro, and Canadian Dollars through trading authority at your bank, brokerage account or retirement savings plan.

Ray Dalio

“I think that the first thing is you should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold”

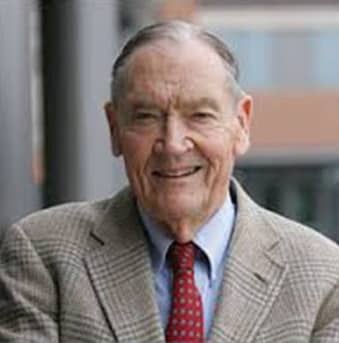

John Bogle

“Don’t look for the needle in the haystack.

Just buy the haystack.”

Warrent Buffett

“Rule No.1: Never lose money

Rule No.2 Never forget rule No.1”